02 9201 5222

Insurance against unpaid invoices

02 9201 5222

Insurance against unpaid invoices

Credit insurance protects your business from the risks of non-payment of invoices. This means your invoices are covered. So if your customer can’t pay you, you’ll still get your money.

The best credit insurers get to know you and your business. They work in partnership with you, supporting you with up-to-date intelligence on markets and sectors. You can use this information to help explore new markets with confidence and offer competitive credit to customers. It also gives you a layer of security that banks tend to like when approached for finance.

We’re one of the world’s leading providers of credit insurance.

Without credit insurance a small company like ours could not afford to take the risk of selling to many markets that require payment terms, especially to unknown buyers and new markets.

We know you’re busy growing your business, that’s why we’ve designed our credit insurance products to be as easy as possible. For a competitive premium, priced to be affordable for small business, you can ensure that you’re covered whenever you sell products or services on credit terms. So you can spend more time focusing on your business, and less time worrying about getting paid.

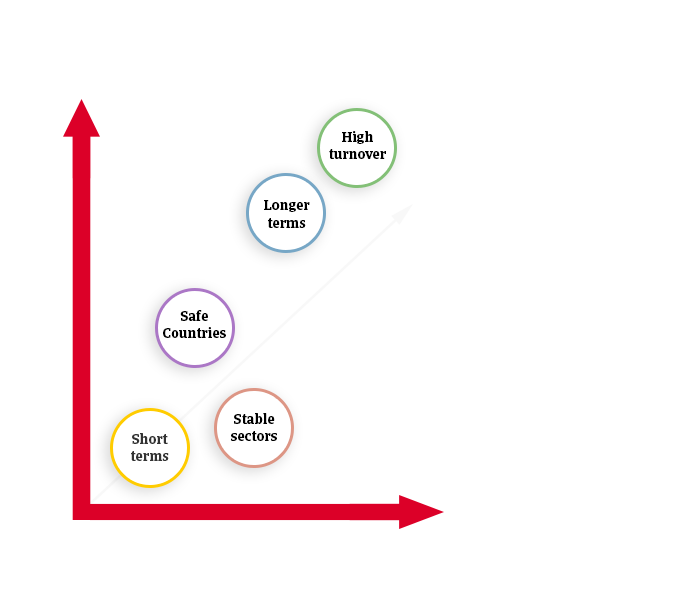

As a guide our policies suit businesses with over $10m revenue and start from $17,500. As with all insurance, there are variables which impact price. Some of these are shown in the chart.

The greater the amount that needs to be insured, the higher the premium cost will be

Sector

Some sectors experience greater market volatility. Risk will be reflected in the premium, with sectors closely monitored for change.

The amount of time you allow your customer before they have to pay you is factored into the premium.

Whether through infrastructure, politics or conflict, some countries pose less trading risk than others. Your premium allows for this.

Examples are for illustration only. Individual risk factors are identified, assessed and monitored for each policy.

If you have any questions or need advice regarding credit insurance for your business we can help.

Talk to us. Our expert advisors will help you get the necessary cover, appropriate for your needs.

Tel: 02 9201 5222

Apply online now

You can apply for a Modula First policy in a matter of minutes. Simply, fill in your details, and we will respond to you without delay.

Instead of blindly going into a relationship with a new customer, we can leverage the information Atradius has in its database to approve credit on potential new customers before the first order ever ships. This gives us a level of security that we wouldn’t otherwise have

Trade with confidence and explore new markets, protected from risks.

Access free market intelligence to help you identify business opportunities.

Expert debt collection can be provided to you at an additional cost.